When Should I Start Investing? 4 Examples of Typical Timelines

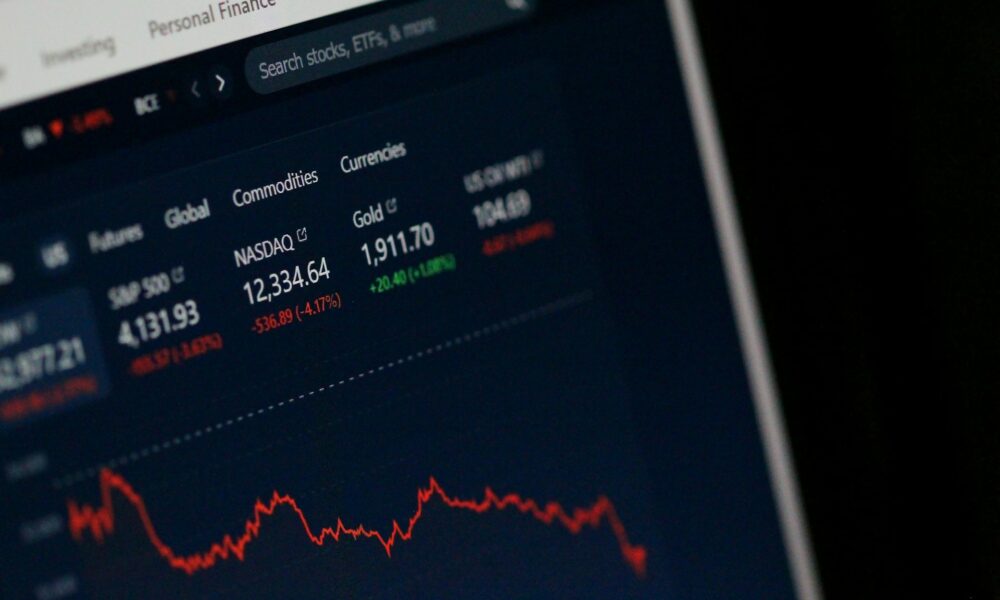

Investing wisely at the right time is important for building wealth and achieving your financial goals. Whether you’re just starting in your 20s or preparing for an imminent retirement, knowing when and how to invest can make a significant difference in your financial future.

This guide will explore typical investment timelines and strategies for each stage of life, from early career investments to retirement planning. It will also discuss key investment options like stocks, real estate, and even how to buy gold, providing examples to help you make informed decisions. Understanding these timelines can set the foundation for a successful financial journey.

1. Early Career: Starting in Your 20s

Beginning to invest in your 20s is a strategic move that can pay off significantly over time. At this stage, focusing on building a solid financial foundation is essential. Start by establishing an emergency fund and paying off high-interest debt.

Once you have covered these basics, consider investing in a diversified portfolio of stocks, bonds, and mutual funds. You can also take advantage of employer-sponsored retirement plans like a 401(k), especially if there’s a matching contribution, which can accelerate your savings.

Also, this is a great time to explore investing in low-cost index funds or ETFs. Starting early allows compound interest to work in your favor, potentially growing your wealth substantially by the time you reach your 30s and 40s.

2. Mid-Career: Your 30s and 40s

In your 30s and 40s, investment strategies should shift towards optimizing growth and preparing for major financial goals. By this stage, it’s crucial to reassess your investment portfolio to ensure it aligns with your evolving financial goals, such as purchasing a home or saving for your children’s education.

Consider increasing contributions to retirement accounts and exploring additional investment options, such as real estate or more aggressive stock investments. This is also a good time to consult with a financial advisor to fine-tune your investment strategy and address major financial milestones.

Diversification is still essential, and you might want to explore alternative safe haven investments, like buying gold, to hedge against market volatility and ensure a well-rounded investment approach.

3. Pre-Retirement: Your 50s and 60s

As you approach your 50s and 60s, it becomes more important to focus on refining your investment strategy to secure a comfortable retirement. This phase involves maximizing retirement contributions to accounts such as 401(k)s and IRAs.

Consider catching up on contributions if you’re over 50 because these accounts often allow higher limits for those nearing retirement. Evaluate your investment portfolio to reduce risk and ensure it aligns with your retirement goals. Transitioning to more conservative investments, such as bonds or stable dividend-paying stocks, can help protect your accumulated wealth.

Also, this is a good time to review your retirement savings and make adjustments if necessary. Consulting with a financial advisor can help create a comprehensive plan, incorporating strategies like diversifying assets to safeguard against economic fluctuations.

4. Retirement: After 65

Once you reach retirement age, the focus shifts from growth to preserving and efficiently managing your assets. At this stage, it’s important to implement a withdrawal strategy that balances your needs with the longevity of your savings.

Consider converting a portion of your savings into income-generating investments, such as annuities or dividend-paying stocks. Maintaining a diversified portfolio can provide stability and protection against inflation. Regularly review and adjust your financial plan to reflect changes in your spending needs and market conditions.

Make sure you have a solid estate plan to manage and distribute your assets according to your wishes. This period is about enjoying your retirement while ensuring financial security and peace of mind for the future.

Investing for Specific Goals

When investing with specific goals in mind, it’s essential to tailor your strategy to meet these objectives efficiently. Whether saving for a child’s education, a major purchase, or a vacation, the key is to define your timeline and required amount.

Short-term goals might benefit from lower-risk investments, such as high-yield savings accounts or certificates of deposit (CDs). For longer-term goals, consider a mix of stocks, bonds, and possibly alternative investments like real estate or precious metals to achieve higher returns while managing risk.

Setting up automatic contributions to dedicated accounts can ensure consistent progress toward your goals. Regularly review and adjust your investment strategy based on changes in your financial situation and market conditions. A well-defined plan aligned with your goals can provide a clear path to achieving them and help you stay on track.

Tailored Paths to Financial Success

Investing for specific goals requires a strategic approach tailored to your objectives and timelines. By defining your goals, selecting appropriate investments, and regularly reviewing your strategy, you can achieve financial success and peace of mind. Remember, whether it’s made to save for a new home or plan for retirement, the right plan can turn your aspirations into reality.